In this paper we show that monetary policies aiming at inflation targeting could not unwind global imbalances in an orderly manner if the GDP level is at potential and growth rates equal potential rates in deficit countries. Instead, as long as output is below potential, easing monetary policies could result in bringing global imbalances to pre-crisis levels. This outcome depends on the state of domestic demand in surplus countries. In the particular case of constrained domestic demand in countries with excess savings, monetary policy easing could result in currency depreciation and, thus, in higher exports and even larger excess savings.

Introduction

Nowadays some economists criticise the easing of monetary policies aimed at re-launching economic growth and bringing output back to potential. For instance, it seems to be widely accepted that the quantitative easing policies pursued by the Fed, the Bank of England, the Bank of Japan or the ECB, as well as the relaxation of the monetary policy in China will re-establish the global imbalances that played a part in the outburst of the crisis, but which were afterwards reduced by it.

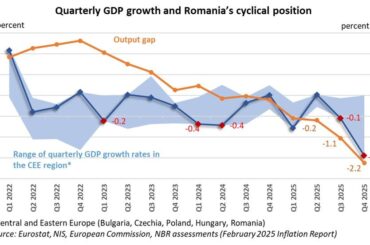

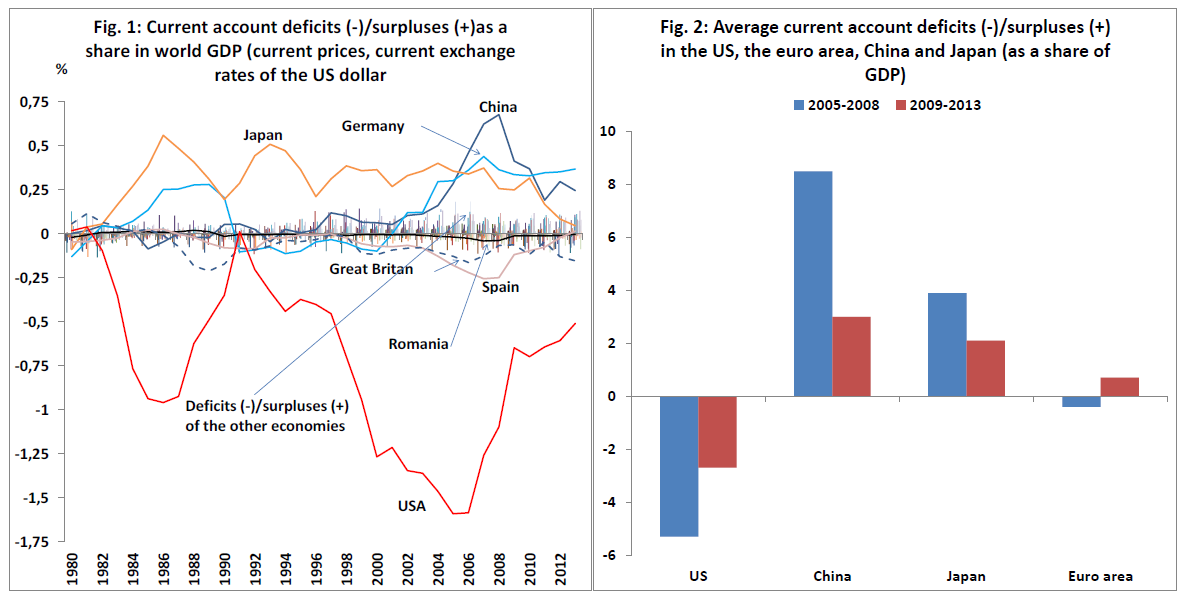

The concern related to the monetary policies of the aforementioned central banks comes from the fact that the countries or the area they represent occupy a special place in the constellation of current account imbalances of the more than 220 world economies. Figure 1 shows that the economies with the greatest imbalances are the US, with a deficit of savings relative to investment, and Germany, China and Japan, with an excess of savings. The latter either “finance” the current account deficit of the US (namely they witness net capital outflows) or accumulate reserves[1]. Implicitly, the US either record net capital inflows or reduce their international reserves. In other words, these countries are counterparts.

Source: author`s calculations; UNCTADstad Source: author`s calculations; the World Bank; FRED

The imbalances among these countries stood at high levels or widened up to the outbreak of the crisis. After the crisis, these counterparts retained their roles from before and merely reduced the size of the imbalances, especially under the influence of cyclical factors (collapse of private demand, decline in oil price, deleveraging, and the drop in asset prices).

More precisely, China and Japan have remained the great financiers and the Eurozone has joined them (Figure 2), thus complicating things even more. In these countries/areas, private income exceeds expenditure by far and the savings resulting from this imbalance are much higher than investment.

If the concurrent monetary policy easing in surplus economies and the likely strengthening of the US monetary policy result in wider imbalances between these economies, then there is an asymmetry with the pre-crisis state of affairs. Before the crisis, monetary policies could not be used to help in the orderly unwinding of imbalances requested by the IMF in its reports as early as 2006-2007[2].

In this context, two questions are warranted: first, “why could not monetary policies unwind global imbalances in an orderly manner before the crisis did it abruptly?” And second, “why could monetary policy easing now, after the crisis, bring the imbalances back to the pre-crisis levels?’’

Such questions cannot be answered “in principle”. One can only speak “in principle” about monetary policies when discussing the principles underlying the monetary policy conduct. These principles are described, for instance, by Mishkin (2007)[3]. Otherwise, the effects of monetary policies pursued in order to achieve inflation and/or employment goals depend on the actual conditions specific to each country or monetary area. These conditions concern demand relative to potential output, the difference between the natural rate of interest and the effective rate, private demand in relation to potential private income, inflation expectations, the difference between actual inflation and the inflation target, debt stock, deleveraging, etc.

Why monetary policies could not unwind global imbalances during a boom

To answer the first question, we will refer to the actual conditions in the US, the country with the largest current account deficit in the world. From 2002 to 2007, the time span before the crisis, output was at potential and the inflation was equal to the implicit inflation target. These conditions show that monetary policy was exactly where theory says it should be and supposedly there were no reasons for strengthening or easing the policy. Consequently, the reduction of the public budget deficit alone could have contributed to the narrowing of the current account deficit, in an attempt to prevent a crisis-induced reduction. The US Government’s budget cash deficit was 2.2 percent of GDP in 2006 and 2.5 percent of GDP in 2007, while the current account deficit stood at 5.8 percent of GDP and 5 percent of GDP respectively.

However, in the aforementioned conditions, a reduction of the budget deficit would have been difficult and would not have had effects on private demand, which was higher than private income. Narrowing the budget deficit would have pushed output below potential and, admittedly, would have diminished inflation expectations. The central bank, which targets inflation, would have reacted by lowering the short-term interest rate and hence the long-term ones in order to ensure the achievement of the inflation target. Consequently, the asset price would have increased and the dollar would have depreciated. The increased value of assets would have prompted households to earmark more funds for spending and companies for investment. The depreciation of the currency would have led to the increase in exports[4].

These decisions of the private sector would have compensated the reduction in output determined by the initial fiscal contraction, but the goal – to narrow the current account deficit – would have been met. However, in order to reach this result, the fiscal authority should have wanted to reduce economic growth through the initial diminution of the budgetary deficit, which would have been politically inconvenient. In the end, US could not have reduced the current account deficit by using macroeconomic policies.

Unlike the US, an economy with a current account surplus could successfully use macroeconomic policies in order to reduce its surplus. Without personalizing, let us suppose this economy increases at a relatively high rate, equal to the potential one, and the current output level is equal to the potential output. A fiscal relaxation – which, in principle, is politically acceptable – would increase public demand, but would not entail an increase in output because the central bank would have to increase the interest rate in order to reach the inflation target. In this case, the value of assets would decrease, therefore private consumption and investment expenditures would decrease as well. With some help from the policy rate hike, the currency would appreciate, slowing down exports and fostering imports, thus narrowing the current account surplus at the end of the day.

If the world economy only consisted of the two economies, the wider budget deficit in the surplus economy would lead to a rise in exports in the economy with a current account deficit. Companies in the deficit economy, prompted by the weaker domestic currency, will want to export more, thereby meeting the increased demand for imports of the country reducing its surplus.

But if there are several surplus economies and only one with a sufficiently wide deficit, as is the actual case in the world economy, then the companies in other surplus economies will want to export more as well. In this situation, the companies in the country with a current account deficit will be able to export more in the country reducing its surplus (thus narrowing their country’s account deficit) only if they are more competitive than those based in other surplus countries. In conclusion, it is not certain whether the financed country narrows its current account deficit when a country reduces its current account surplus.

Why monetary policy easing could bring the global imbalances to pre-crisis levels

To answer the second question (“why could monetary policy easing now, after the crisis, bring the imbalances back to the pre-crisis levels?”), it is necessary to identify the actual post-crisis environment.

Basically, there have been some sweeping changes. In most economies, the level of demand is much lower than the potential output level, despite widening budget deficits up to limits no longer financeable by the market. Moreover, in developed economies, private sector demand has collapsed and is still way below potential private incomes. Against this background, the central banks in developed countries have first reacted by lowering the monetary policy rate to virtually zero. Then they proceeded to the extreme relaxation of the monetary policy through quantitative easing rounds in order to bring inflation to the implicit or explicit target level. Out of the countries mentioned in Figure 2, China was the only one which did not need to resort to quantitative easing, but it also loosened the monetary policy very much in order to stimulate investments[5].

Whether monetary policy easing in these countries leads or not to wider external imbalances in the future depends on each economy’s actual conditions regarding the two components of demand, i.e. domestic and external. As long as the actual conditions do not allow monetary policy easing to stimulate domestic demand in countries with excess savings (current account surplus), but rather only lead to the depreciation of the currency, external imbalances will increase. Recently, in an article published in the Financial Times, Martin Wolf (2015) showed that this could be the case in the period ahead.

In a nutshell, Wolf (2015) shows that “it is hard to believe in a sustainable domestic spending boom”, even amid the ECB’s quantitative easing rounds, “given the large debt overhangs […], the absence of fiscal expansion and the fact that households and businesses […] are reluctant to spend”[6]. The ECB’s policy would bear fruit only if the weaker euro prompted a boom in exports which would increase the current account surplus[7].

Wolf (2015) does not see a recovery of domestic demand in China or Japan either. In the case of the former, the credit-fuelled investment boom has become unsustainable. In the case of Japan, the level of public debt has soared, which renders it difficult to continue the policy of fostering demand by widening budget deficits. However, the depreciation of the yuan and of the yen respectively would lead to a rise in exports, which would increase the current account surpluses, but would help economic growth[8]. On the other hand, the counterparts for these larger surpluses in the Eurozone, China and Japan cannot be emerging or developing countries, which “are not creditworthy enough”[9], but the US, the most capable of taking the risk of large capital inflows.

I share most of the arguments and rationale in Wolf’s article. Indeed, given the actual state of domestic demand in the biggest economies with current account surpluses, the monetary policies pursuing quantitative easing could lead to higher current account surpluses. However, given the precarious conditions of domestic demand, the increase in such surpluses could be the only chance of a rise in output.

This chance is all the greater as, unlike in the Eurozone, in the US and the UK, i.e. the largest counterparts financed (Figure 1), the GDP has exceeded the pre-crisis levels, nearing potential even more, and the quantitative easing programs have ended. Therefore, the USD and the GBP will not be subject to depreciation pressure[10]. On the contrary, the combination of loose monetary policies in the financing areas (Eurozone, China, Japan) and a tightened monetary policy in the US[11] will contribute to the appreciation of the USD, which will reflect in the deterioration of the US current account. The widened current account deficit in the US will remain the main counterpart of the widened surpluses in the Eurozone, Japan and China, relatively similar to the pre-crisis period.

However, we cannot wrap up the analysis by concluding that monetary policy easing in the Eurozone, China and Japan will ultimately lead to an increase in exports and hence in GDP in those countries. This could be the happy ending of monetary policy easing and of imbalance widening provided that the imbalances stabilize at the levels recorded when current output would reach the potential level again.

This happy ending is, however, hard to anticipate, for two reasons: (i) it is not certain whether the current rounds of monetary policy easing, having an impact especially on the currency depreciation channel, will lead to a boom in exports, capable of raising output to potential; (ii) even so, while increased exports will lead to a faster GDP growth rate, the larger excess savings will keep the real interest rate low or reduce it even more, including in the financed countries (the US and other countries with a current account deficit). Thus, the increase rate of GDP will be substantially higher than the real interest rate in all counterparts, which is enough to generate a new credit boom that would fuel a new asset price bubble (Tirole, 1985).

However, a bubble can also emerge if the interest rate is higher than the GDP increase rate in certain conditions that make speculative growth generate larger resources for investment (Caballero, Farhi and Hammour, 2006)[12]. In this case, the impact of a bubble on economic growth can favour welfare if it occurs in the late stage of speculative growth, once growth has consolidated and the probability for the growth path to crash has diminished (Caballero, Farhi and Hammour, 2006).

The downtrend in economic growth rates that started in the ‘70s in developed countries has been going on to date. In the absence of structural reforms seeking to revive economic growth in the long run, the trend may persist. A new bubble would only interrupt this trend once again. Lawrence Summers (2013) thinks that, in the US, the aggregate demand in the absence of a bubble was very low in the pre-crisis period and that it was raised to potential due to the 2002-2007 bubble. Robert Gordon (2014) believes, however, that the potential level of GDP has decreased very much in time and therefore economic growth remains subdued.

One way or another, a new asset price bubble will push output to potential and/or the potential rate of growth to relatively high levels[13]. Thus, the bubble will coexist with relatively high economic growth and with low and stable inflation. So may be the case in other developed countries as well. If so, we will have to learn to see the benefits of an economic bubble as well, not just the disasters occurring when it bursts.

On the other hand, if demand in the absence of a bubble is not way below potential, as seems to be the case in emerging economies, non-euro area EU Member States included, the bubble will act differently. We will see again relatively high rates of economic growth, pushed by the economic bubble beyond potential, and current account deteriorations[14].

Nonetheless, there will be a while until then. In the meantime, we will have to wait and see if the depreciation of the euro, the yuan and the yen can generate an export boom that makes a success out of monetary policy easing in the Eurozone, China and Japan.

Conclusions

In order to attain the specific objectives, monetary policies will always take into account the actual conditions of the living systems called national economies or monetary areas. Ilya Prigogine and Isabelle Stengers (1984) showed that living systems have “dissipative structures” (which allow the exchange with the outside world), make a choice each time they are at a “crossroads”, re-establish “order through fluctuations” and they are almost always “far from balance”. This is actually the normal state in nature.

We should not crave for a world in which all economies have current account deficits virtually equal to zero. In such a world, capitals would be strictly controlled and the efficiency would be very low. The necessary resources to maintain balances at zero or, on the contrary, to support exaggerated imbalances exceed by far the available resources. The resources at our disposal and our aspirations regarding the living standards make it so that we are sufficiently “far from balance” most of the time.

The US, China, Japan, the UK and the Eurozone are the largest “dissipative structures” of the global system. Our analysis has shown that, nowadays, these economies are not sufficiently “far from balance” to produce enough jobs and increase general welfare[15]. Current actual conditions of private demand call for wider external imbalances in these economies in order to revive economic growth. The monetary policies pursued to increase inflation and employment will lead to the necessary expansion of imbalances in the US and the UK, as well as in the Eurozone, Japan and China.

These evolutions should not be a matter of concern. On the contrary, given the excess savings in some economic areas, the re-widening of current account imbalances may be the only way to increase production and jobs, at least for a while.

However, when the sober expectations that are still guiding our actions inevitably give way to euphoric ones, the imbalances will widen beyond the level required to take economic growth to potential. Nonetheless, as shown in this article, macroeconomic policies will not help prevent the excessive widening of imbalances, nor can they be used for the orderly narrowing of imbalances. It will then become apparent that the recent years’ financial overregulation will be useless as well.

Notes:

References

Caballero, Ricardo; Emmanuel, Farhi; Mohamad, L. Hammour (2006), “Speculative Growth: Hints from the U.S. Economy”, American Economic Review 96(4): 1159-1192.

Croitoru, Lucian (2013), “The Eurozone: An Inconvenient Truth”, Romanian Journal of Economic Forecasting 2/2013, p. 200.

Croitoru, Lucian (2015), “’Stagnarea seculară’, ‚’bulele salvatoare’ și creșterea economicăîn România” [“‘Secular Stagnation’, ‘Saving Bubbles’ and Economic Growth in Romania”] http://www.bnro.ro/Studii,-analize,-puncte-de-vedere-4009.aspx, p. 30.

Gordon, Robert (2014), “The turtle’s progress: secular stagnation meets the headwinds”, in Teulings, Coen and Richard Baldwin (ed.) (2014), “Secular stagnation: facts, Causes and Cures”, A VoxEU.org Book, CEPR Press.

Krugman, Paul; Obstfeld, Maurice (2003), “International Economics: Theory and Policy”, Addison Wesley, Sixth Edition, p. 314.

Mendoza, Enrique G.; Marco, E. Terrones (2008), “An Anatomy of Credit Booms:

Evidence from Macro Aggregates and Micro Data”, NBER, Working Paper 14049

http://www.nber.org/papers/w14049.

Mishkin, Frederic S. (2007), “Will Monetary Policy Become More of a Science?”

Working Paper 13566, http://www.nber.org/papers/w13566, NBER (October).

Prigogine, Ilya; Isabelle Stengers (1984), “Order Out of Chaos: Man’s New Dialog with Nature”, Bantam Books.

Summers, Lawrence (2013), “IMF Fourteenth Annual Research Conference in Honor of Stanley Fischer”, Washington, DC, November 8, http://larrysummers.com/imf-fourteenth-annual-research-conference-in-honor-of-stanley-fischer/.

Tirole, Jean (1985), “Asset Bubbles and Overlapping Generations”, Econometrica, Vol. 53, No. 6. (Nov. 1985), pp. 1499-1528.

Wolf, Martin (2015), “Unbalanced hopes for the world economy: it is futile to ignore the reality that we have an integrated global system”, Financial Times, February 17.

- Basically, the economies with surpluses either have net capital outflows or accumulate reserves, while the economies with a current account deficit either have net capital inflows or cut their international reserves. In principle, at global level, the sum of these net capital inflows and outflows and of the changes in reserves should be equal to zero. However, it seems that, in practice, the global imbalance is not equal to zero, which made Krugman and Obstfeld speak about “the mystery of the missing surplus” (Krugman and Obstfeld, 2003).

- Mainly the World Economic Outlook and the Global Financial Stability Report, issued in autumn and spring so that they can be discussed at the Annual Meetings of the Board of Governors of the IMF.

- Briefly, these principles are: (i) the interest rate influences aggregate demand, which in turn determines short-term output fluctuations; (ii) there is a trade-off between inflation and unemployment in the short term, (iii) in the long run, there is no such trade-off, meaning that money is neutral; (iv) economic agents’ expectations crucially influence the inflation and respond to monetary policy; (v) credible assessments of monetary policies are rule-based; and, finally, (vi) financial frictions influence the business cycle.

- The condition discussed in the text, namely that output is at potential and the GDP growth rate is equal to the potential rate, does not represent a particular case. Even if the output level and the growth rate were above potential, we would still end up to the case discussed in the text. Assuming that the divine coincidence holds, monetary policy will increase the interest rate up to the level at which current output would regain its potential level. From this perspective, the reasoning within the text is valid. In other words, the coordinated reduction of imbalances remains a problem if, once output has sustainably decreased to potential, the current account deficit is still relatively high.

- China’s share of fixed capital investment in GDP increased during 2007-2012 by 7.1 percentage points, from 39 percent in 2007 to 46.1 percent in 2012. This growth is unsustainable and was promoted to compensate for the decrease of the export share in GDP by 5.9 percentage points, from 38.3 percent in 2007 to 27.7 percent in 2012.

- Indeed, in the Eurozone, as in all developed countries, for that matter, the rate of time preference rate has dropped considerably in the aftermath of the crisis, probably running below the interest rate level. Consequently, households and companies overall have a propensity for saving, with savings becoming excessive not only in Germany and other countries of the “economic north” of the Eurozone, but in some countries of the “economic south” as well. From a current account deficit of 1.5 percent of GDP in 2008, the Eurozone ended up having a surplus of 2.4 percent of GDP in 2013. The deflation that emerged in December 2014 could last until the second part of 2016, increasing the real interest rate (which is above its natural level anyway), which exacerbates the debt burden and accelerates deleveraging. All these together limit substantially the effect of quantitative easing on the increase in euro area domestic demand.

- I presented a similar view in January 2012, showing that a truly expansionary monetary policy of ECB, which would lead to euro depreciation, cannot be avoided (Croitoru, 2013). Quantitative easing could lead to further euro depreciation, thus stimulating exports outside the Eurozone. The increase in exports will add new jobs, allowing countries time to implement the necessary structural reforms on the labour market and on the goods and services market. Nevertheless, the current account surplus of the Eurozone will widen given the increased exports. Thus, the increase in the current account surplus will help GDP growth, which will, however, remain weak until structural reforms pay off.

- In China and Japan, the excess of savings continues to be high, even if it has narrowed after the crisis (Figure 1). In both countries, the high volume of savings reflects a low time preference rate, which indicates a perpetual delay of expenses. Given the propensity for saving, loose monetary policies will have effects especially on the channel of yuan and yen depreciation respectively, particularly in relation to the US dollar. An increase in current account surpluses is to be expected in these countries as well, given the depreciation of their currencies. But, here as well, the increase in surpluses that worries some economists is necessary in order to enhance the increase in GDP.

- In EU emerging economies, predictable conditions tend to make necessary the further easing of monetary policies, which shows that private demand continues to remain relatively weak. The cut in interest rates could weaken the respective currencies, which will rather continue to stimulate exports, temporarily diminishing their role as financed counterparts. The dollar will remain strong, to the extent to which the US remains the main such counterpart.

- Any delay in the UK synchronising the interest rate growth cycles with those in the US will probably translate into depreciation pressures on the GBP versus the US dollar.

- Probably starting with June 2016.

- In the classical approach, Tirole’s included (1985), bubbles are a positive event in an economy with a structure that leads to over-saving and overinvestment, as is the case now, for instance, in post-crisis China. Within this framework, the bubble merely absorbs resources that, otherwise, would lead to over-accumulation issues. In the framework described by Caballero, Farhi and Hammour (2008), investment increases with the evolution of the bubble, because there are enough financing resources generated by speculative growth, to which adds the optimism on their sustainability. The conditions mentioned by Caballero, Farhi and Hammour (2008), which allow this “growth-funding feedback” between the stepped-up output and effective available funding (feedback that de facto generates speculative growth) are (i) technological progress concurrent with expansion, (ii) fiscal surpluses generated by rules, (iii) weak economic growth in the rest of the world, and (iv) the easing of financing conditions by the very feedback between growth acceleration and increased available funding.

- An asset price bubble can coexist with a step-up in the growth rate of potential output and an interest rate cut. Thus, an economic bubble can coexist with high growth equal to potential, while inflation remains low and stable, as was the case in the US and in other developed countries in the run-up to the crisis that broke out in July 2007. The mechanism whereby this coexistence can be reached depends on a combination of positive shocks in productivity and in the time preference rate and is described in Croitoru (2015). As shown by Mendoza and Terrones (2008), the credit boom required to fuel a bubble is preceded by a positive productivity shock, which lends support to the explanation based on positive shocks.

- No bubble occurred in Romania, although in the last three years the condition mentioned in the text has been met. The explanation probably lies with the fact that the discrepancy between the two rates was small and that, in the absence of some solid capital inflows, the GDP growth rate was relatively low, although higher than the real interest rate.

- Once the economic growth accelerates in these countries, positive implications for the economic growth will occur in other countries as well.

Monetary Policy and the Global Imbalances (the euro, the dollar, the yen and the yuan) – published first in Romanian under the title Euro, dolarul, yenul și yuanul (The euro, the dollar, the yen and the yuan). The English version was published in Central Bank Journal of Law and Finance, No. 1/2015, the National Bank of Romania, pp. 57-68.

JEL Classification: F01; F21; F40; E52; E58.

* Lucian Croitoru is Monetary Policy Senior Advisor to the Governor of the National Bank of Romania