The IMF study I have been asked to make comments on tackles a very complex subject, which it does by covering several decades of development efforts and a large number of economies.

There are several messages in this study with which I agree and which deserve to be highlighted from the very start:

– Reforms can enhance potential economic growth and help convergence;

– Reforms cannot produce results instantaneously and they should be judged in a holistic manner, in their inter-relationships;

– Reforms impact vested interests, that will withstand change;

– Reforms may incur social and economic costs at the start; therefore, timing is essential;

– The international environment matters, and unless favorable, it may slow down reforms;

I would add that structural reforms are even more needed in view of the impact the Great Recession has had on economic activity around the world, on the investment appetite, which suggests that emerging economies need to trigger domestic drivers of economic growth.

In my remarks I will focus on what I see as relevant circumstances in Europe (EU) nowadays and in the foreseeable future, with roots in deeply going tendencies in the global economy. I will refer to the Romanian experience as well. And I do so as the EU forms a particular economic region in the world, a “bloc”to put it bluntly.

Heterogeneity is a key word in this study, as conditions vary considerably among economies; this is why conclusions need to be qualified when warranted. From this perspective I proceed next.

- Let me first highlight major dynamics in Europe after 2000 –when it was clear that joining the EU (with its the Single Market) was to happen:

– Catching up has taken place on a large scale. Romania’s GDP/head, for instance, while at around 22-23 of EU average in 2002-2003 stands at around 63-64% in PPP terms now. But as the study justly argues, together with basic institutions and mechanisms of a market economy, inclusion is a must for sustainable reforms and economic stability;

– Catching up has gone through a major bump during 2009-2012; potential growth as thought of in both advanced (AE) and emerging economies (EM) before the Great Recession has been dented by almost half (1,5 from2-2.5% in AEs and 3.0-3.5% from 5-6% in EEs, according to some estimates); this augments the significance of this report;

– The Study rightly emphasizes the importance of good governance. I would add the “intellectual ownership” of policies and reforms; good institutions will make more difference in the years to come as scarce resources would be with us for the long term in view of the impact of adverse shocks, climate change, market disruptions, wars and other major conflicts!!

– Institutional reforms and strong institutions, defending the rule of law and not allowing vested interests to capture the state and its policy-making apparatus, diminishing rent-seeking, combating monopolies (whether public or private) and market power abuse, inclusion, underpin a well functioning economy; all this contributes to a sense of fairness in society (and fairnessis key in understanding social strife in Europe nowadays)

– The Report deals with finance, trade, product, labor markets and governance reforms, with the supply side. But policies can vary; they need to be smart and pragmatic (open-minded, as Dani Rodrik would say) if an economy is to overcome the middle income trap. WB, IMF, EBRD reports, after the first and the second decade of transition, stressed that simply privatizing and freeing prices are not sufficient to this end;

– Good policy-making implies avoiding egregious policy mistakes. An example in Romania is Ordinance 114, that contained, among others, a nonsensical “innovation”: linking a bank assets tax with the monetary policy rate, basically taxing monetary policy. Fortunately, a damage control reaction was possible; but that ordinance still has to be dealt with.

– The context does matter greatly and the Report is unambiguous about it: when conditions are favorable, it is easier to undertake reforms. But key parameters of the global context have been shifting fundamentally. Just think about:

a/ the erosion of the liberal international order and fragmentation of the global economy. A de-globalization process seems to be underway. Geopolitics and security concerns play a major role here (de-coupling of industrial sectors for defense reasons (US-China); this will affect supply chains quite likely and foster the creation of regional groupings, of blocs. How would EU economies compete in this new world?

b/ currency and trade wars; monetary policies as a proxy for currency wars

c/ the expansion of shadow banking and new systemic risks…

d/ technologies that are highly disruptive; cyber-fare; digitalization induces more inequality unless high skills are evenly distribute in a world of growing disparities

d/ climate change can be highly disruptive; business models need to take into account and change themselves;

e/ parallel currencies can bring havoc in money markets

g/ the proliferation of tail events –that highlight the need for ROBUSTNESS

h/ the importance of liquidity in markets (the recent repo market glitch in the US); we should fear sudden stops;

i/ financial stability as an increasing concern due to persistent low interest rates, low economic growth rates, market fragmentation, adverse shocks;

j/ very low interest rates (a big decline of the neutral rate during the last 30 years) mean a dramatic “policy regime change” (as Olivier Blanchard put it) in AEs, which impacts EEs heavily;

l/ But as the IMF GFS report argues “Lower rates for longer are accompanied by increasing vulnerabilities…”

q/FDI in EEs are less than before the GFC, while search for yield flows gain in significance due to QE policies; EEs need to use domestic resources more efficiently in any way possible. The Report considers probably this reality as a working assumption;

– Wherever reforms can bring about substantial efficiency gains they must not be delayed; reforms should happen by considering complementarities;

– Controlling macro imbalances is a must for EMs; both public and private borrowing do matter –this is the experience of EEs worldwide;

– Do “rules” in the global economy change for the EEs too when it comes to fighting inflation and using “unconventional policies” to combat recession” (read the last issue of the Economist). I would say such an inference is highly misleading since where deficits are large and a central bank does not issue a reserve currency embarking on what some AEs do would be a road to disaster!!!

– Unless macro imbalances are controlled reforms are hard to undertake;

– EMs in Europe face an increasing labor shortage, partially due to massive emigration. The study is pretty silent in this respect, though to be fair IFIs have dealt with this issue lately. Finding ways to move “informality” into “formality” would help. As would making markets operate more flexibly (exit and entry) also help;

– Tax evasion and tax avoidance plagues both AE and EE. This is particularly relevant for Romania, where fiscal revenues are very low (below 26% of GDP); fiscal regime arbitrage is a curse in todays’ world…

– The report hardly mentions industrial policies as a means to gain competitive advantages. In several successful middle sized economies supporting education and R&D, targeting particular sectors, were instrumental to this end. But where weak institutions operate, industrial policies pose major risks…In addition, it is hard to formulate such policies in the context of the Single Market logic and rules. Nonetheless, EEs need to innovate in order to gain competitive edges. The EU itself needs its own industrial policies in order to compete with the US and China

– Where an economy is placed in GVCs (global value chains), in European production chains is critical; and this hinges on many variables, including strategies of international companies.;

– Security and geopolitical concerns can shorten supply chains, would make them more regional;

– The study puts emphasis on domestic finance reforms, on deregulation. But this was a must for EEs upon entering the EU and the logic of the Single Market strengthens it. The actual issue is not deregulation, especially after the Great Financial Crisis. What kind of regulation and supervision in order to make finance serve the real economy better is the issue;

– Finance needs to be properly regulated, and macro-prudential policies have to find ways to mitigate destabilizing capital flows. Surges in credit can overwhelm an economy (this was EEs’ experience during before 2009; policy tools were weak in view of the logic of the Single Market and the prevailing paradigm at the time);

– The plight of SMEs is more severe in not a few EEs in Europe than what the report suggests. Our economies are basically “dual” when it comes to funding;big companies have easy credit access, internally or externally, while local companies face a huge handicap in this respect.

– Financial intermediation has declined much in some EEs, in Romania and Hungary mostly; private credit went down from cca 38% in 2008 to about 27% of GDP in 2018 in Romania; this is quite sobering;

– Do EEs in Europe need promotional banks in views of foreign groups’ s retrenchment propensities and the need to mobilize resources internally, including EU funds? I think yes, but such banks should be run efficiently and the involvement of IFIs in running them is welcome

B. Let me refer to the Romanian economy more specifically:

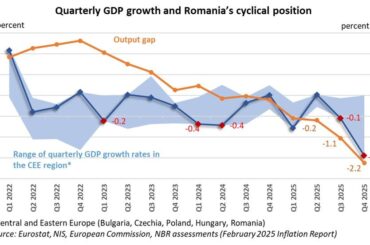

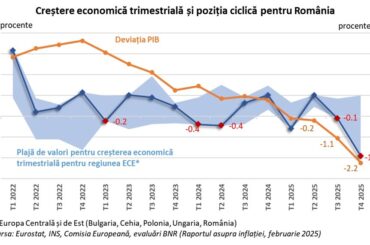

– Catching up, economic growth have resumed after 2012, after a vey severe macroeconomic correction;

– But this process has been driven primarily by consumption in recent years, by unusually big rises in wages; partly this was an attempt to address the outflow of human capital, but this policy has gone too far, with bad effects;

– We need to change gears, to invest more for sustainable growth. There is need of a changed policy complexion and thrust: 1/control (reduce) excess demand, 2/ more investment, 3/ focus on the supply side to unleash growth drivers;

– Budget and incomes policy has entailed a rapid rise in external imbalances after 2016, which has become a concern;and this has occurred while the public budget is highly strained, with very low fiscal revenues (cca 26% of GDP); this policy has also fueled inflation’

– Structural reforms have stalled and public administration has ballooned in size;

– The labor market is distorted by massive emigration and big rises in public sector wages (though, when it comes to mitigating human capital outflow, some rises were inevitable…)

– Erratic and frequent changes in fiscal legislation unnerve and create major uncertainties for business;

– Many state companies need better governance, good professionals at the helm;

– There is need to enhance the motion from “informality” to “formality” via good incentives; the Study makes a very good case in this regard; raising the minimum wage has likely helped in this regard in various sectors, but one needs to be careful with further rises;

– Financial discipline is extremely poor and the chain of arrears is a stranglehold for many small companies; most of them have hardly access to credit and this reinforces “informality”

– There is a clear inability to set priorities, not least when it comes to major investment projects, that can produce positive externalities in cascade. The inability to use EU funds properly epitomizes a weak institutional set up;

– There is chronic underfunding of healthcare and education (among the lowest in the EU as a share of GDP) –one again one sees the importance of having a solid public budget, of higher fiscal revenues;

– Raising fiscal revenues is a must in Romania. This is as critical as key structural reforms.The reform of ANAF (The tax collection agency) is badly needed; Bulgaria and Poland did it and the results were stunningly positive. This is not rocket science; it asks for political will and the stamina to fight vested interests (many of whom practice tax evasion)

– Reforming a bloated public sector is an urgency; but juggling with numbers such as axing 1/3 of the public sector employees “just like that” does not help the cause of reforms…Reforms need to be socially palatable and some of them may take time. It is also true that one should not procrastinate in this respect.

To conclude: Good news is that structural reforms can help an economy grow more rapidly over the medium and longer term; it can add to what is judged as potential growth at one point of time, as the IMF Study argues. But one should also keep in mind a dramatically changed overall environment and that:

– Dealing with macroeconomic imbalances is critical right now: unless we control the budget deficit and external imbalances things can turn pretty nasty in the not too distant future. When saying this I do not underestimate the importance of structural reforms in any way whatsoever.

– This macro correction has to take place at a time of economic slowdown in Europe and when headwinds proliferate; unless we act in timely fashion another bout of a severe pro-cyclical macro correction will be inevitable;

– It is critical for the budget in 2020 to have a deficit under control; this would arguably involve: a freeze of income rises as much as possible (not cut them!!!); change the calendar for the implementation of the pensions law and scale down the programmed rises, no more cuts in taxes, eliminate loopholes, increase EU funds absorption as a means to buttress public expenditure, fight tax evasion and tax avoidance resolutely;

– Prioritize, fund investment projects in a multi-annual financial framework;

– Streamline and reform public administration

– Step up infrastructure development as a prerequisite for moving up higher in European value chains;

– spending more on education is a must…the importance of a solid public budget (raise fiscal revenues to 30% of GDP in a few years time)

– an arrangement with the European Commission to assist reforms would help much and discipline policies so that euro area accession should not simply be a public relations exercise; with public deficits out of control such an official aim, purportedly to be achieved in a few years time, is a phantasy.

Daniel Daianu: comments on “Reigniting growth in emerging market and low income economies; what role for structural policies”, by Davide Furceri et.al, IMF, October 2019 (NBR, Bucharest, October 15th, 2019)[1]

[1] These comments do not necessarily reflect the official views of the institutions the author is affiliated with